A) real estate

B) currency

C) traveler's checks

D) oil

E) checkable deposits

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Fed primarily uses the reserve requirement to control the money supply.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A single bank can increase the money supply by the increase in its excess reserves times the simple money multiplier.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the First National Bank acquires $500,000 in new deposits and the required reserve ratio is 12 percent. Which of the following is true?

A) The First National Bank can increase the money supply by $500,000.

B) The First National Bank can increase the money supply by $400,000.

C) The First National Bank can increase the money supply by $440,000.

D) The entire banking system can increase the money supply by no more than $500,000 if the First National Bank lends out its excess reserves.

E) The entire banking system can increase the money supply by no more than $440,000 if the First National Bank lends out its excess reserves.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Fed wishes to make only a small change in the money supply. Which of its policy tools is it most likely to use?

A) the prime interest rate

B) loans made to the public

C) Fed Fund Rate

D) open market operations

E) the required reserve ratio

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The actual money multiplier is smaller than the simple money multiplier because

A) the actual multiplier involves M2 rather than M1

B) cash withdrawals reduce the amount banks can lend out

C) withdrawals from checkable deposits increase the amount of excess reserves each bank receives

D) the Fed wants to reduce the money supply

E) the actual multiplier uses a different measure of reserve requirements

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exeter Bank has $100 million in checkable deposits and $10 million in net worth. With a 10% reserve requirement, Exeter Bank must maintain ______ in reserves.

A) $1 million

B) $2 million

C) $5 million

D) $10 million

E) $11 million

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people choose to hold some of a newly received loan as cash instead of keeping it in a checking account, the money supply

A) will not increase as a result of that loan

B) decreases as a result of that loan

C) will not increase as much from that point on as it would if borrowers redeposited all of the money because the cash withdrawal increases excess reserves

D) will not increase as much from that point on as it would if borrowers redeposited all of the money because cash is not included in the money supply

E) will not increase as much from that point on as it would if borrowers redeposited all of the money because the cash withdrawal decreases excess reserves

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not legal tender in the United States?

A) a $2 bill

B) a fifty-cent piece

C) a $100 bill

D) a $5 Federal Reserve Note

E) a check

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tony deposits $2,000 in cash at the Last National Bank and the bank credits Tony's checking account in the amount of $2,000. Which of the following is true immediately after this transaction?

A) The money supply, M1, increases by $2,000.

B) Only the composition of M1 changes, not its amount.

C) A $2,000 loan from the Last National Bank is an asset to Tony.

D) Both the assets and the liabilities of the Last National Bank fall by $2,000.

E) The immediate effect of this transaction is that M1 increases by $2,000 times the money multiplier.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Usually, a commercial bank's depositors and its owners are the same individuals.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the Fed buys U.S. government securities from a bank, that bank's required reserves and total reserves increase but excess reserves decrease.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The money supply expands when banks make loans.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest component of M1 is

A) currency

B) checkable deposits

C) traveler's checks

D) money market mutual fund accounts

E) savings accounts

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By holding highly liquid assets to guard against sudden large withdrawals, banks

A) sacrifice safety

B) sacrifice profitability

C) increase profitability

D) hold less cash in their vaults

E) earn more interest than they could on business loans

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bank reserves can be held in the form of

A) loans and cash in the bank's vault

B) loans and deposits with the Fed

C) loans and checking accounts

D) deposits with the Fed and cash in the bank's vault

E) deposits with the Fed and checking accounts

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a liability for a bank?

A) U.S. government securities

B) deposits with the Fed

C) checkable deposits

D) consumer and business loans

E) building and furniture

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The liquidity of an asset indicates

A) its buying power

B) the ease with which it can be converted into the medium of exchange without a significant loss of value

C) the ease with which it can be converted into another asset

D) how likely people are to convert it into the medium of exchange without a significant loss of value

E) how easy it is to buy with a check

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not money?

A) check

B) coin

C) currency

D) debit card

E) credit card

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

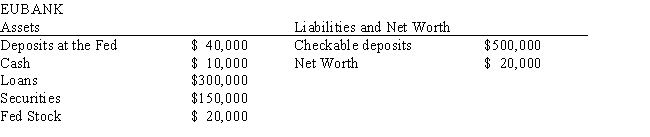

Exhibit 15-1  -Refer to Exhibit 15-1. If the interest rate on loans is 10 percent, the annual cost to Eubank of holding excess reserves is

-Refer to Exhibit 15-1. If the interest rate on loans is 10 percent, the annual cost to Eubank of holding excess reserves is

A) 10 percent of $500,000

B) 10 percent of net worth

C) 10 percent of excess reserves

D) $10,000

E) 0

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 229

Related Exams